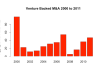

Editor?s Note: This is Redpoint VC?Tomasz Tunguz?s third article in a series examining trends in the public and private technology markets. (Here are one and two.) It is widely believed that the stock market is a leading health indicator for the venture industry. In reality, however, the performance of the S&P 500 tells us very little about trends in the fundraising market. For this week's analysis, I evaluated correlating factors for VC fundraising and VC investment using annual data from the NVCA and Yahoo Finance from 2001 to 2011. I examined five possible correlating variables: number of IPOs, aggregate IPO value (proceeds from IPO), number of M&A transactions, aggregate M&A value and the performance of the S&P 500 (year over year change). This analysis time shifts the data by one year.

Editor?s Note: This is Redpoint VC?Tomasz Tunguz?s third article in a series examining trends in the public and private technology markets. (Here are one and two.) It is widely believed that the stock market is a leading health indicator for the venture industry. In reality, however, the performance of the S&P 500 tells us very little about trends in the fundraising market. For this week's analysis, I evaluated correlating factors for VC fundraising and VC investment using annual data from the NVCA and Yahoo Finance from 2001 to 2011. I examined five possible correlating variables: number of IPOs, aggregate IPO value (proceeds from IPO), number of M&A transactions, aggregate M&A value and the performance of the S&P 500 (year over year change). This analysis time shifts the data by one year.Source: http://feedproxy.google.com/~r/Techcrunch/~3/tu5w4Dy5T7g/

best cyber monday deals best cyber monday deals cyber monday grover norquist grover norquist nfl week 12 picks nfl week 12 picks

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.